- The Caregiver’s Guide to Thriving: How to Hold It Down Without Losing Yourself

- The Legal Side of Love and Responsibility

Sis, imagine holding it all down—career, side hustle, family—and then finding out you’re legally responsible for a loved one’s medical care and debt.

It’s a reality for many caregivers, especially Black women who carry the weight of generational care. While caregiving is an act of love, it can also come with legal strings attached. You’ve got enough on your plate without being blindsided by policies you didn’t even know existed.

This post is your blueprint to understanding the financial and legal realities of caregiving—so you can stay empowered, protect your peace, and build your legacy.

We see you, navigating the needs of everyone around you while trying to secure your future. For many caregivers, the weight of financial obligations can feel overwhelming. You deserve clear guidance to protect yourself and your family while continuing to show up for those you love.

What Are Filial Responsibility Laws?

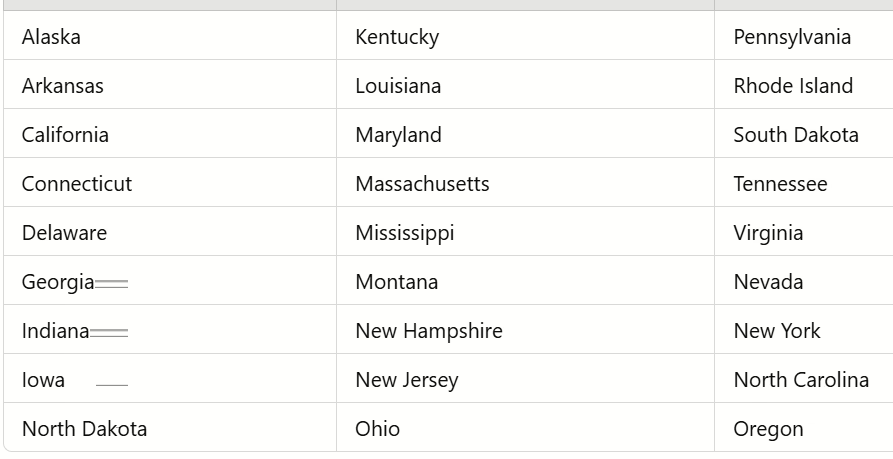

Filial responsibility laws exist in 27 U.S. states and Puerto Rico, requiring adult children to financially support their aging parents if they cannot care for themselves.

What This Means for You:

In some cases, you could be responsible for:

- Unpaid nursing home bills

- Medical expenses

- Basic living needs like food and shelter

Case Example:

In 2012, John Pittas of Pennsylvania was ordered to pay $93,000 for his mother’s nursing home bill. The nursing home sued him after his mother failed to pay and moved to Greece. The court decided he was financially capable, even though his mother didn’t request support.

States with Filial Responsibility Laws

If you live in one of these states, you may have a legal obligation to support your parents:

The Doctrine of Necessaries: What This Means for Spouses

The Doctrine of Necessaries requires spouses to support each other’s essential needs, such as medical care, housing, and food.

Key Implications:

- You could be held responsible for your spouse’s unpaid medical expenses.

- Even if your spouse qualifies for Medicaid, certain costs may still fall on you.

Medicaid Protections: Avoiding Financial Devastation

For married couples, Medicaid’s spousal impoverishment protections allow the healthy spouse to keep part of the couple’s income and assets:

- Community Spouse Resource Allowance (CSRA): Allows the non-institutionalized spouse to retain part of the household’s assets.

- Federal minimum (2024): $29,724

- Federal maximum (2024): $148,620

- Monthly Maintenance Needs Allowance (MMNA): Ensures the community spouse can keep a portion of their monthly income for living expenses.

- MMNA range: $2,465 to $3,715.50 (varies by state)

The Financial Toll of Caregiving on Black Women

Black women are more likely to take on caregiving responsibilities—and often with fewer financial resources:

- 1 in 3 Black households includes a family caregiver (Source: AARP).

- Black caregivers spend an average of $6,600 annually out of pocket for caregiving-related expenses.

- Nearly 57% of Black caregivers work full-time jobs in addition to their caregiving roles, increasing the risk of burnout and financial strain.

Fly Savvy Sol Insight: 3 Smart Money Moves to Protect Your Legacy

- Understand Your State’s Laws

Research your state’s policies regarding filial responsibility and spousal care obligations. - Plan Ahead with Financial Tools

- Establish trusts and annuities to protect your assets.

- Invest in long-term care insurance to cover future expenses and shield your income.

- Schedule a Consultation with Financial Experts

Having a personalized financial plan can make all the difference when navigating caregiving obligations. A 30-minute consultation could save you tens of thousands of dollars—and provide priceless peace of mind.

Why Proper Financial Planning Matters

Financial planning isn’t just about money—it’s about peace, control, and empowerment. When you have a clear plan in place:

- You avoid financial surprises that can destabilize your goals.

- You create a roadmap to protect your family and pass down generational wealth.

- You gain clarity about available options like long-term care insurance, trusts, and Medicaid planning.

Imagine having a team that walks you through everything—so you’re making empowered decisions, not reactive ones.

Comprehensive Caregiver Resource Guide

1. Financial Assistance Programs

- Medicaid Home and Community-Based Services (HCBS) Waivers: Helps cover in-home care, respite services, and medical equipment to keep loved ones out of nursing homes.

- Website: Medicaid.gov

- Veterans Affairs (VA) Caregiver Support Program: Provides a monthly stipend, mental health counseling, and access to a Caregiver Support Coordinator for family members of veterans.

- Website: VA Caregiver Support

- National Family Caregiver Support Program (NFCSP): Offers financial aid for home modifications, meal delivery, and respite care.

- Website: ACL.gov

- Supplemental Security Income (SSI): Monthly payments for low-income individuals who are elderly or disabled.

2. Respite Care and In-Home Support

- National Respite Network: A searchable database of respite care providers to give caregivers a break.

- Website: ARCH National Respite Network

- Program of All-Inclusive Care for the Elderly (PACE): Provides comprehensive medical and social services to eligible seniors so they can stay at home rather than in nursing homes.

- Website: PACE Program

- Eldercare Locator: Connects caregivers to local support services such as meal delivery and transportation.

- Website: Eldercare Locator

3. Legal and Financial Planning

- National Academy of Elder Law Attorneys (NAELA): Helps caregivers find legal professionals specializing in Medicaid planning, trusts, and estate planning.

- Website: NAELA

- AARP Legal and Financial Resources: Provides estate planning checklists and free financial tools.

- Website: AARP Caregiving Resources

- Consumer Financial Protection Bureau (CFPB): Offers guides on protecting seniors from financial fraud and navigating power of attorney.

- Website: CFPB Financial Caregiving Resources

4. Mental Health and Emotional Support

- Caregiver Action Network (CAN): Provides a free 24/7 caregiver help desk and support forums.

- Website: Caregiver Action Network

- Therapy for Black Girls: Connects Black women to culturally competent mental health professionals.

- Website: Therapy for Black Girls

- BetterHelp: Offers affordable online therapy sessions with flexible scheduling.

- Website: BetterHelp

5. Educational Programs and Training

- Powerful Tools for Caregivers: Provides workshops on communication, self-care, and stress management for caregivers.

- Website: Powerful Tools for Caregivers

- Alzheimer’s Association Training: Offers educational programs for caregivers of loved ones with dementia.

- Website: Alzheimer’s Association

- Family Caregiver Alliance (FCA): Provides online webinars and courses tailored to caregiving needs.

- Website: FCA Resources

6. Tax Benefits and Deductions

- Dependent Care Credit: Up to 35% of qualifying caregiving expenses for adult dependents.

- Medical Expense Deductions: If caregiving-related expenses exceed 7.5% of your adjusted gross income, you may be able to claim them.

Fly Savvy Sol Insight: Keep detailed records of medical expenses, home modifications, and mileage for medical-related trips to maximize your tax benefits.

7. Advocacy and Policy Resources

- National Council on Aging (NCOA): Provides financial support resources and advocates for caregiver-friendly policies.

- Website: NCOA

- Black Women’s Health Imperative (BWHI): Focuses on improving the health and financial wellness of Black women caregivers.

- Website: BWHI

Community Connection: Your Stories Inspire

We’re building a legacy of support. Here’s what some Fly Savvy Sol readers have shared:

- “I didn’t realize filial laws were even a thing until my mom needed nursing home care. Scheduling a consultation helped me feel in control instead of overwhelmed.” – Brianna W.

- “The insight about long-term care insurance saved us when my husband needed in-home care after his stroke.” – Carmen R.

Your journey can be different. You don’t have to navigate caregiving alone—we’re here to guide you.

Take Action Today

Sis, you didn’t come this far to play small. It’s time to secure your peace and protect your legacy. Schedule your free, no-obligation financial consultation today and get the clarity you need to make empowered decisions for yourself and your family.

Click here to book your consultation —we’ve got you.